Imagine having the power to invest in real estate without the hassle of buying properties yourself. Fundrise’s eREITs offer just that, providing you with a unique opportunity to diversify your investment portfolio and potentially grow your wealth.

You might be wondering how these eREITs perform and what makes them stand out in the crowded investment landscape. You’ll uncover the secrets behind Fundrise’s eREITs, their performance, and why they could be the right choice for your financial future.

Get ready to discover how you can make your money work smarter, not harder, by tapping into the world of real estate investment trusts.

Fundrise Ereits Overview

Fundrise eREITs offer a modern way to invest in real estate. They open doors for investors to access real estate assets. These eREITs are designed for the everyday investor. They provide an opportunity to diversify portfolios with ease. Let’s explore what makes eREITs unique and how Fundrise approaches real estate investing.

What Are Ereits?

eREITs are a type of real estate investment trust. They operate electronically, hence the “e” in eREIT. These trusts allow investors to pool money together. The funds are used to purchase or finance real estate projects. Unlike traditional REITs, eREITs are accessible online. This digital approach simplifies the investment process. Investors can easily track their investments via online platforms.

Fundrise’s Approach To Real Estate Investing

Fundrise focuses on transparency and accessibility. They provide a platform for investors to engage directly with real estate. Fundrise selects diverse projects across the country. This diversity helps spread risk and maximize potential returns. Their team evaluates each project carefully. They aim to find opportunities with strong growth potential. Fundrise also emphasizes lower fees compared to traditional methods. This allows more of the investor’s money to work for them.

Credit: www.financialsamurai.com

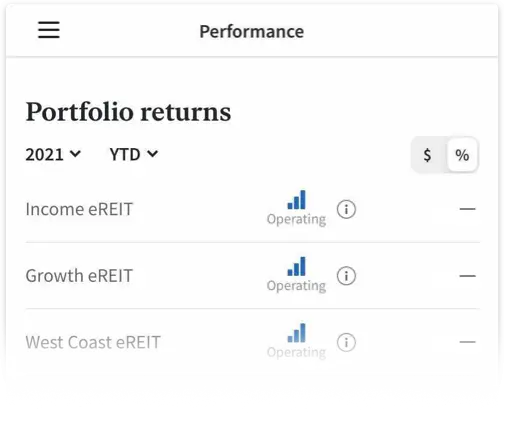

Performance Metrics

Performance metrics are crucial for understanding Fundrise’s eREITs. These metrics shed light on how well eREITs are doing. Investors use these to gauge returns, stability, and growth.

Key Performance Indicators

Key performance indicators (KPIs) offer insights into eREITs’ health. Common KPIs include occupancy rates and cash flow. Occupancy rates show how many units are rented. Higher rates indicate strong demand. Cash flow measures money moving in and out. Positive cash flow means more money is coming in than going out. Both KPIs help evaluate eREITs’ success.

Comparing Ereits To Traditional Reits

eREITs differ from traditional REITs in many ways. Traditional REITs often trade on stock exchanges. eREITs are typically not publicly traded. This can impact liquidity. eREITs might offer more consistent returns. Traditional REITs can be volatile due to market swings. Both have unique advantages. Comparing them helps investors choose wisely.

2025 Market Trends

Fundrise’s eREITs show promising growth in 2025 market trends. These real estate investments attract attention for their consistent performance. Investors appreciate the stability and potential returns.

As we step into 2025, the real estate investment landscape is buzzing with potential. Fundrise’s eREITs have become a popular choice for many investors. But what can you expect from the market trends this year? Here’s what you need to know about the evolving dynamics that could shape your investment journey.Real Estate Market Shifts

The real estate market is always in flux, and 2025 is no exception. You’re likely to see shifts that might alter your investment strategy. Urban areas continue to grow, drawing in more people and businesses. This can boost property values and rental incomes, presenting opportunities for eREIT investors. Technology plays a crucial role too. Smart buildings and digital platforms are making property management more efficient. Have you considered how these advances might enhance the performance of your eREIT investments? Housing preferences are changing. Millennials and Gen Z are favoring rental options over buying homes. This trend could increase demand for rental properties, potentially boosting eREIT returns.Impact Of Economic Factors

Economic factors are pivotal in determining the direction of real estate investments. Inflation, interest rates, and employment levels can influence your eREIT’s performance. Inflation may increase costs but could also drive property values higher. Are you prepared to navigate this dynamic? Interest rates are another key factor. Lower rates can make borrowing cheaper, encouraging property purchases and development. However, rising rates might make financing more expensive, impacting eREIT growth. Employment levels affect housing demand. A strong job market can boost rental demand, benefiting eREIT investors. Are you keeping an eye on employment trends in your target areas? As you consider these factors, how will they influence your investment decisions? Understanding these market dynamics can help you make informed choices that align with your financial goals.

Credit: www.financialsamurai.com

Investment Strategy Analysis

Fundrise’s eREITs have become a popular choice for investors. This section explores their investment strategy analysis. Understanding how Fundrise structures its eREITs can offer insights into their performance.

Diversification Benefits

Diversification is key in Fundrise’s strategy. eREITs hold various types of real estate assets. This includes residential, commercial, and industrial properties. Spreading investments across different sectors reduces reliance on a single market. It limits exposure to specific economic downturns. Investors gain stability through varied property types.

Risk Management Techniques

Fundrise employs effective risk management strategies. They focus on thorough property analysis before investment. This ensures high-quality asset selection. Regular performance reviews help maintain portfolio health. They adjust strategies based on market trends. This proactive approach minimizes potential losses. Investors benefit from reduced risks in their portfolios.

Investor Sentiment

Investor sentiment plays a crucial role in understanding the market dynamics of Fundrise’s eREITs. Investors often rely on past performance and potential growth to form opinions. Sentiments can influence decisions and impact the overall market perception of eREITs. Let’s explore the feedback from investors and the long-term outlook for these investments.

Feedback From Ereit Investors

Fundrise eREIT investors often share varied feedback. Many appreciate the ease of access and low entry barriers. The platform’s transparency garners positive responses. Investors value clear information on asset performance and returns. Some investors express concerns about liquidity. eREITs typically require long-term commitments. Despite this, satisfaction levels remain high. Many find returns meet or exceed expectations.

Long-term Investment Outlook

The long-term outlook for Fundrise eREITs appears promising. Real estate continues to grow as a robust investment sector. eREITs offer a unique advantage in this space. They provide diversification across different properties. This mitigates risks associated with market fluctuations. Investors can expect steady growth over time. Fundrise’s model focuses on strategic, diversified investments. This approach supports a positive long-term outlook. Many investors see eREITs as a reliable addition to their portfolios.

Future Projections

Fundrise’s eREITs are attracting attention for their promising future projections. Investors are curious about what lies ahead. This section explores the growth potential and challenges facing these digital real estate investment trusts.

Growth Potential

Fundrise’s eREITs have shown impressive growth. Technology plays a key role here. It enables efficient management and reduces costs. This appeals to investors looking for consistent returns. The digital platform allows easy access to diverse real estate assets. This diversification reduces risk and enhances growth prospects.

Another factor driving growth is the expanding real estate market. Urban development and infrastructure improvements fuel demand. eREITs can capitalize on these opportunities. They offer a simple way for investors to enter the real estate market. This is important as more people seek stable investment options.

Challenges Ahead

Despite positive projections, challenges are inevitable. Market volatility is a major concern. Economic shifts can affect property values. Investors must be aware of these fluctuations. Regulatory changes also pose challenges. Real estate laws vary by region. Staying compliant requires constant vigilance.

Competition is another hurdle. More platforms are entering the digital real estate space. Fundrise must maintain its unique selling proposition. It must offer competitive returns to retain its investor base. These challenges require strategic planning and adaptability. Only then can eREITs continue their upward trajectory.

.webp)

Credit: www.realbricks.com

Frequently Asked Questions

What Is A Typical Return On Fundrise?

Fundrise typically offers an average annual return of 8-12%. Returns vary based on market conditions and investment type. Past performance doesn’t guarantee future results, so individual experiences may differ. Always review current data and consult financial advisors for specific guidance.

Can You Actually Make Money With Fundrise?

Yes, you can make money with Fundrise. It offers returns through dividends and asset appreciation. Investing in real estate via Fundrise involves risks, but many users have reported positive returns. Diversification and long-term investment strategies can enhance potential earnings. Always research before investing.

What Happens After 5 Years With Fundrise?

After 5 years with Fundrise, investors typically experience portfolio growth and receive dividends. Fundrise allows reinvestment or withdrawal options. Users can track performance via their dashboard, ensuring transparency. Long-term commitment often enhances potential returns, aligning with real estate market trends.

How Has Fundrise Performed?

Fundrise consistently delivers strong returns with a diversified real estate portfolio. Investors report satisfaction with its performance. The platform offers transparency and user-friendly experience, attracting many users. Past performance shows steady growth, though future results may vary. Reviews highlight Fundrise’s reliability and potential in real estate investing.

Conclusion

Fundrise’s eREITs offer an accessible investment option for many. They provide consistent returns and diversify portfolios. Investors enjoy the ease of online management. These eREITs show promising performance over time. They suit those seeking steady growth. Simplicity and efficiency attract many users.

Suitable for both beginners and experienced investors. Understanding their potential can aid in smart investing choices. Consider Fundrise’s eREITs for a balanced portfolio. They might be the right fit for your investment goals. Always research and consider risks before investing.

Your financial journey starts with informed decisions.